The Evolution of Bitcoin

In the digital landscape, few innovations have ignited as much fascination and speculation as Bitcoin. Born from the enigmatic pseudonym Satoshi Nakamoto, Bitcoin emerged in 2009 as the pioneer of cryptocurrencies, revolutionizing the financial realm forever. Its inception marked the dawn of a new era, challenging traditional notions of currency and finance.

Understanding Bitcoin: A Technological Marvel

The Blockchain Revolution

At the heart of Bitcoin lies the blockchain, a decentralized ledger technology that underpins its operations. The blockchain serves as a transparent, immutable record of transactions, ensuring security and trust in a trustless environment.

Mining: The Backbone of Bitcoin

Bitcoin mining, the process through which new coins are created and transactions are validated, is central to the network’s functionality. Miners utilize powerful computing resources to solve complex mathematical puzzles, thereby confirming transactions and securing the network.

The Socio-Economic Impact: Redefining Financial Paradigms

Financial Inclusion and Accessibility

Bitcoin has democratized access to financial services, empowering individuals worldwide to participate in the global economy irrespective of geographical barriers or socio-economic status. Its decentralized nature eliminates the need for intermediaries, reducing transaction costs and increasing financial inclusivity.

Hedge Against Inflation and Economic Uncertainty

In an era plagued by economic volatility and inflationary pressures, Bitcoin has emerged as a store of value and a hedge against traditional financial risks. With a finite supply capped at 21 million coins, Bitcoin offers a deflationary alternative to fiat currencies susceptible to inflationary policies.

Evolutionary Milestones: From Obscurity to Mainstream Adoption

Institutional Acceptance and Investment

In recent years, Bitcoin has garnered significant attention from institutional investors and corporate entities seeking exposure to digital assets. High-profile endorsements and investments from renowned companies have propelled Bitcoin into the mainstream spotlight, legitimizing its role as a viable asset class.

Regulatory Landscape: Navigating Uncertainty

While Bitcoin’s ascent has been meteoric, regulatory challenges remain a key consideration for its widespread adoption. Governments and regulatory bodies worldwide are grappling with the implications of decentralized currencies, seeking to strike a balance between innovation and regulatory oversight.

Beyond Borders: Bitcoin’s Global Impact

Remittances and Cross-Border Transactions

Bitcoin facilitates seamless cross-border transactions, offering a cost-effective alternative to traditional remittance channels plagued by exorbitant fees and lengthy processing times. Its borderless nature enables individuals to transfer value swiftly and securely across geographical boundaries.

Empowering the Unbanked

For the millions of unbanked individuals worldwide, Bitcoin represents a lifeline to financial inclusion and economic empowerment. By bypassing traditional banking infrastructure, Bitcoin enables individuals to access financial services, store wealth, and engage in economic activities autonomously.

The Evolution of Bitcoin: Paving the Path to Digital Transformation

Technological Advancements and Innovation

As Bitcoin continues to evolve, technological advancements such as the Lightning Network and Segregated Witness (SegWit) hold promise for enhancing scalability and efficiency within the network. These innovations aim to address existing challenges while laying the foundation for broader adoption and utility.

Environmental Considerations: Towards Sustainable Solutions

Addressing concerns surrounding energy consumption and environmental impact is paramount for Bitcoin’s long-term sustainability. Initiatives promoting renewable energy sources and green mining practices are emerging, signaling a shift towards more sustainable approaches to cryptocurrency mining

Introduction:

In the realm of modern finance and technology, few innovations have garnered as much attention and controversy as Bitcoin. Born out of the enigmatic mind of Satoshi Nakamoto, Bitcoin has evolved from a niche concept discussed among cryptographers to a global phenomenon that has disrupted traditional financial systems and sparked heated debates about its implications for society. This article explores the evolution of bitcoin, from its humble beginnings to its current status as a revolutionary force reshaping our understanding of currency, economics, and governance.

The Evolution of Bitcoin:

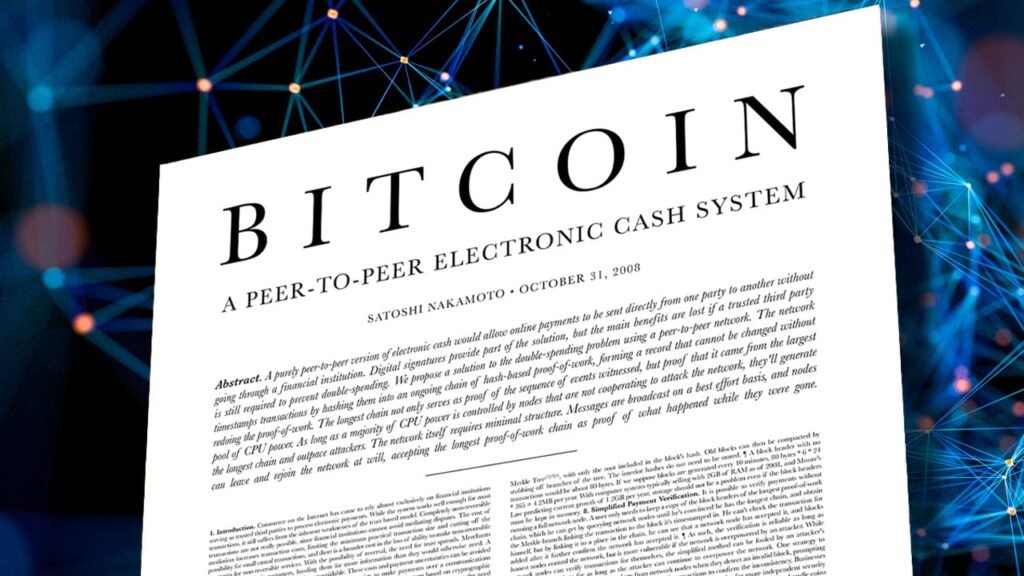

Bitcoin emerged in 2008 when Satoshi Nakamoto, an anonymous individual or group of individuals, published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The whitepaper outlined a vision for a decentralized digital currency that operated on a peer-to-peer network, bypassing the need for intermediaries like banks or governments. Satoshi’s creation addressed longstanding issues with traditional fiat currencies, such as inflation, counterfeiting, and centralization, by employing cryptographic techniques and a distributed ledger known as the blockchain.

The Genesis Block:

On January 3, 2009, Satoshi Nakamoto mined the first block of the Bitcoin blockchain, known as the “genesis block,” marking the official launch of the Bitcoin network. Embedded within the genesis block was a message referencing a headline from The Times newspaper that read: “Chancellor on brink of second bailout for banks.” This symbolic gesture highlighted Bitcoin’s genesis as a response to the 2008 financial crisis and a critique of the traditional banking system’s shortcomings.

Early Adoption and Challenges:

In its infancy, Bitcoin faced skepticism and ridicule from mainstream financial institutions and governments, who viewed it as a tool for illicit activities or dismissed it as a passing fad. However, a passionate community of developers, libertarians, cypherpunks, and tech enthusiasts rallied behind Bitcoin, driving its adoption and development. The early years were marked by volatility, hacks, and regulatory uncertainty, but Bitcoin persevered, demonstrating resilience in the face of adversity.

The Rise of Altcoins and Blockchain Innovation:

As Bitcoin gained traction, it paved the way for the emergence of alternative cryptocurrencies, or “altcoins,” each offering unique features and use cases. Alongside the proliferation of cryptocurrencies, blockchain technology, the underlying technology behind Bitcoin, gained recognition for its potential to revolutionize industries beyond finance. Innovations such as smart contracts, decentralized applications (DApps), and permissionless blockchains opened new avenues for experimentation and disruption.

Mainstream Recognition and Institutional Adoption:

In recent years, Bitcoin has transcended its niche status to become a mainstream asset class, attracting attention from institutional investors, corporations, and even governments. High-profile endorsements from industry titans like Elon Musk and institutional players like MicroStrategy and Square have lent credibility to Bitcoin as a legitimate store of value and hedge against inflation. Furthermore, the growing Evolution of Bitcoin as a payment method by major companies like PayPal and Tesla has enhanced its utility and mainstream appeal.

The Socio-Economic Impact of Bitcoin:

Beyond its financial implications, Bitcoin has profound socio-economic implications, challenging conventional notions of money, power, and governance. Bitcoin empowers individuals by providing financial sovereignty, enabling borderless transactions, and offering protection against censorship and confiscation. Moreover, Bitcoin has the potential to reduce financial inequality by providing access to financial services for the unbanked and underbanked populations worldwide

Frequently Asked Questions (FAQ)

- What is Bitcoin? Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, allowing users to send and receive payments without the need for intermediaries like banks or governments. It was created by an anonymous individual or group of individuals known as Satoshi Nakamoto and was introduced in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

- How does Bitcoin work? Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers (nodes). Transactions are verified by network participants through cryptographic techniques, and once verified, they are added to the blockchain. Bitcoin transactions are processed by miners, who compete to solve complex mathematical puzzles in exchange for newly minted bitcoins and transaction fees.

- What is blockchain? Blockchain is the underlying technology behind Bitcoin and other cryptocurrencies. It is a distributed ledger that records all transactions in a secure and transparent manner. Each block in the blockchain contains a cryptographic hash of the previous block, creating a chain of blocks that cannot be altered retroactively. Blockchain technology has applications beyond finance, including supply chain management, voting systems, and decentralized applications (DApps).

- How can I acquire Bitcoin? There are several ways to acquire Bitcoin. You can purchase it from cryptocurrency exchanges using fiat currency (such as USD, EUR, or GBP) or other cryptocurrencies. You can also earn Bitcoin through mining, although this requires specialized hardware and technical expertise. Additionally, you can receive Bitcoin as payment for goods or services, or you can participate in activities like staking or lending to earn Bitcoin rewards.

- Is Bitcoin legal? The legality of Bitcoin varies from country to country. While some countries have embraced Bitcoin and enacted regulations to govern its use, others have imposed restrictions or outright bans. It’s essential to consult local regulations and seek legal advice before buying, selling, or using Bitcoin in your jurisdiction.

- Is Bitcoin anonymous? Bitcoin transactions are pseudonymous, meaning they are not directly tied to real-world identities but are recorded on the public blockchain. While Bitcoin addresses do not reveal personal information, transactions can be traced and analyzed using blockchain analysis tools. Users can enhance their privacy by using techniques like coin mixing or using privacy-focused cryptocurrencies.

- What are the risks associated with Bitcoin? Investing in Bitcoin carries several risks, including price volatility, regulatory uncertainty, security breaches (such as hacks or scams), and technological vulnerabilities. Additionally, Bitcoin’s decentralized nature means there is no central authority to recourse in case of disputes or loss of funds. It’s essential to conduct thorough research and exercise caution when dealing with Bitcoin or any other cryptocurrency.

- Can Bitcoin be used for illegal activities? While Bitcoin itself is not inherently illegal, it has been associated with illicit activities due to its pseudonymous nature and decentralized architecture. Criminals have used Bitcoin for activities such as money laundering, drug trafficking, and ransomware payments. However, it’s essential to recognize that the vast majority of Bitcoin transactions are legitimate, and many law enforcement agencies have developed tools to track and apprehend criminals using cryptocurrencies.

- What is the future of Bitcoin? The future of Bitcoin is subject to speculation, but many proponents believe it has the potential to become a global reserve currency and a cornerstone of the decentralized finance (DeFi) ecosystem. As Bitcoin continues to mature and gain mainstream acceptance, its value proposition as a hedge against inflation and financial censorship may become more pronounced. However, challenges such as scalability, regulatory scrutiny, and competition from other cryptocurrencies could shape its trajectory in the years to come.

- Where can I learn more about Bitcoin? There are numerous resources available for learning about Bitcoin, including online courses, books, podcasts, and forums. Websites like Bitcoin.org, CoinDesk, and Bitcoin Magazine provide news, analysis, and educational content about Bitcoin and the broader cryptocurrency ecosystem. Additionally, attending cryptocurrency conferences and joining online communities like Reddit’s r/Bitcoin can provide valuable insights and opportunities for discussion with fellow enthusiasts